Built for Australian reporting entities

AML software with configurable rules for clean alerts

WatchEye unifies identity checks, sanctions screening and live transaction monitoring in one no-code suite. Configure alert rules to fit your risk model, see true-risk notifications instantly and export AUSTRAC-ready reports without extra headcount.

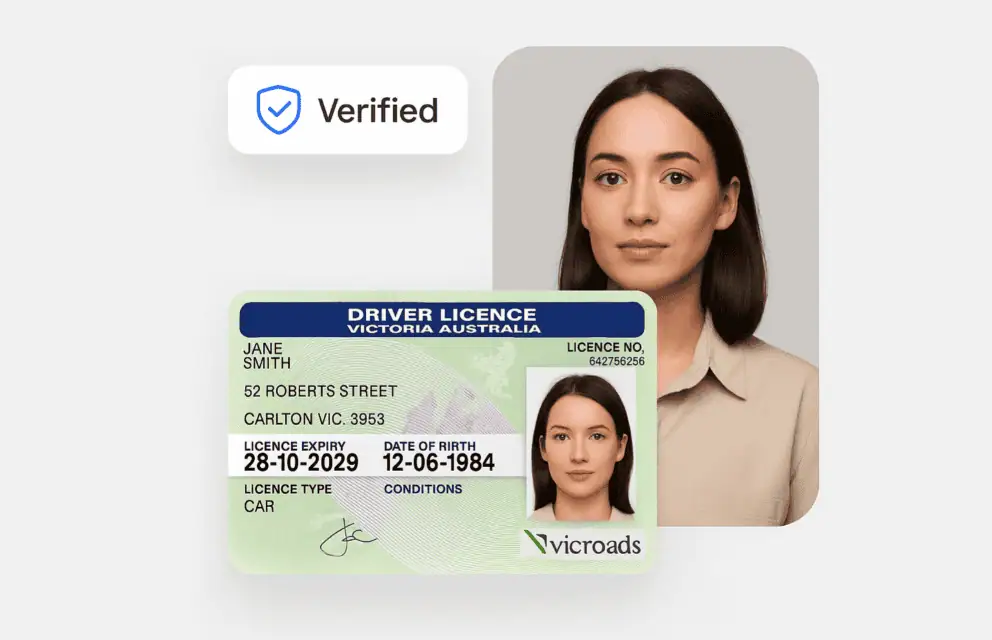

Verify identity data, DVS documents, liveness and biometrics in seconds.

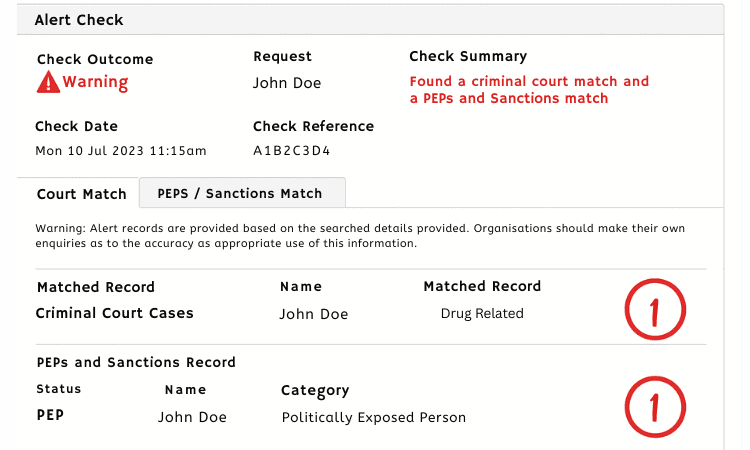

Reduce false positives through configurable rules.

Schedule continuous customer file, sanctions, PEP and transaction monitoring.

Export audit-ready reports for AUSTRAC in minutes.

Integrate easily via the no-code dashboard or API.