WatchEye: A Complete Customer Onboarding, Monitoring & Risk Intelligence Solution

WatchEye is a comprehensive, industry-leading SaaS and API-based risk intelligence platform, purpose-built to provide a seamless end-to-end solution for managing the entire customer journey, from onboarding to offboarding. Whether you’re screening new customers, verifying identities, monitoring transactions, or ensuring ongoing compliance, WatchEye offers a full suite of data intelligence tools. These tools are fully configurable, without the need for coding and can be customised to align with your specific business processes.

Complete Customer Onboarding

One System for Complete Verification

Unify customer onboarding, screening, and monitoring inside our easy to use WatchEye platform. Configure once then scale. Reduce effort and automate while meeting changing regulatory needs.

Customer Verification

Check ID’s and combine with or without liveness and biometrics.

Customer Screening

Perform single or schedule multiple automated adverse screening checks.

Fraud Alerts

Receive instant, real-time alerts on suspicious customer profiles or transactions.

What Can WatchEye Monitor?

PEPS & Sanctions

Identity Data

Adverse Media

Customer Data Changes

Address Changes

Adverse Court Cases

Deceased Data

KYB Changes

Transactions

Email Data

Phone Data

Do Not Call Register

IP Addresses

Property Transactions

Asset Purchasing

The WatchEye Advantage

WatchEye goes beyond standard monitoring systems by offering a no code, fully customisable, end-to-end platform that integrates Customer Screening, Identity Verification, Document Verification, Biometric Verification, as well as Ongoing Monitoring. It is generally accessed via our cloud SaaS portal, but is also available via API. With advanced monitoring and alert capabilities, WatchEye keeps your business secure by instantly notifying you of any changes or suspicious activities to your customer files, allowing for prompt and decisive action.

WANT THE FACTS BEFORE MAKING A DECISION? OUR OVERVIEW PROVIDES YOU WITH KEY FEATURES AND PRICING OPTIONS

Get Our Complete Product Overview and Pricing Guide Today

How does it work?

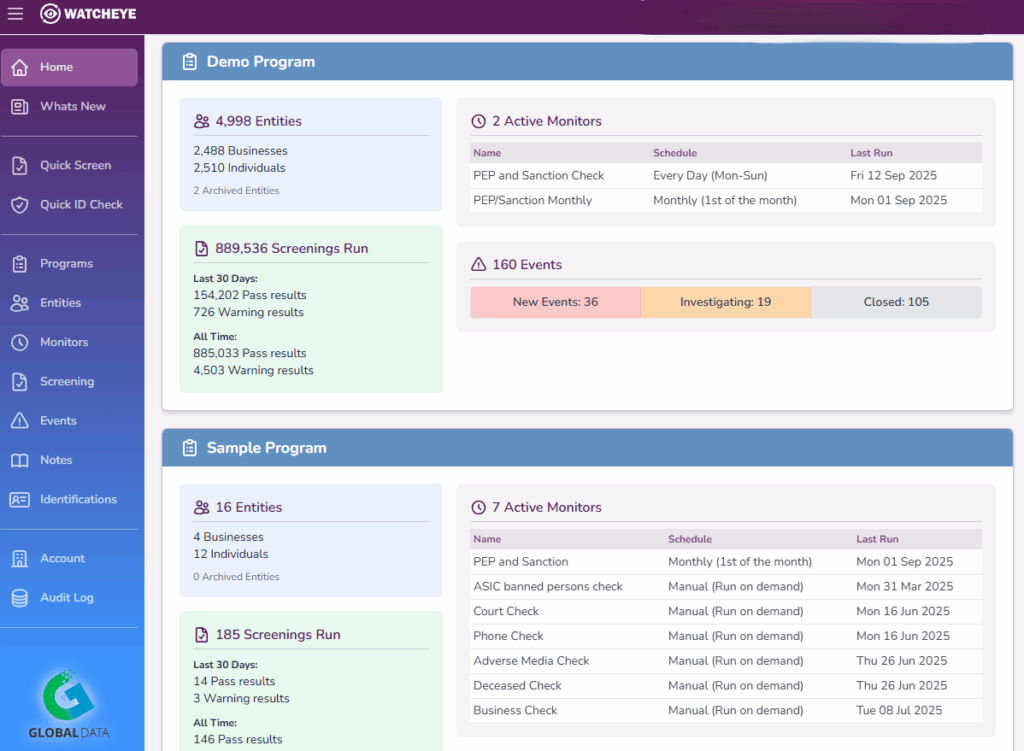

WatchEye simplifies the monitoring process into four easy steps, ensuring that your organisation remains secure and compliant with minimal effort.

A Complete End-to-End Experience

Deliver a complete customer onboarding experience, enrolling as many customers as needed. WatchEye provides a complete onboarding, monitoring and risk intelligence solution that allows both SaaS and API user access.

Real-Time Identity Verification & KYC

Instantly perform verifications and customer due diligence checks. Run multi-layered identity checks against authoritative Australian data sources.

Tailor Your Screening Programs

Tailor WatchEye to meet your specific compliance needs with intuitive, no-code customisable alerts and monitoring rules.

Multi-File Monitoring & Scheduling

Set up as many monitoring programs as needed within the one system and set customised frequencies of alerts that fit your operational workflow.

Ongoing Customer Due Diligence (OCDD)

Meet Ongoing Customer Due Diligence (OCDD) requirements through continuous surveillance. Receive instant notifications for any customer changes in your data files.

PRODUCT PURPOSE

WatchEye is a leading product solution that specialises in

ID Pass provides a fast, reliable, and user-friendly solution for verifying customer identities with minimal friction.

Ensure AUSTRAC compliance with Global Data’s AML solutions, offering robust monitoring, reporting, and risk management capabilities.

Leverage our financial crime management solutions for thorough Enhanced Customer Due Diligence, continuous monitoring, and effective management of Politically Exposed Persons.

Common Questions about WatchEye

What do you mean by End-to-End Customer Onboarding?

End-to-End Customer Onboarding refers to a comprehensive, seamless process that covers every stage of a customer’s journey, from the initial interaction with your business to their continuous management and offboarding. WatchEye is used to manage the entire process.

Does WatchEye have Identity Verification as well?

Yes, you have the option of sending an automated IDPass link to your clients, to ‘self-verify’ on their smartphone, or you can perform one-to-one manual checks if you prefer.

Can I select my own alerts and monitoring programs?

Yes, absolutely. You can simply load your customers in WatchEye, select the monitor or monitors of preference, set the automated checking schedule, set the alert threshold and manage identities separately or together with the screening monitor.

How does WatchEye help with regulatory compliance?

By providing automated monitoring and reporting tools designed to meet global and local standards such as AUSTRAC’s AML/CTF requirements, WatchEye offers features like PEPs, Sanctions, Adverse Media, Criminal Court screening and identity verification to ensure businesses stay compliant with relevant regulations and reduce the risk of penalties.

Can I set different rules for different types of customers?

Yes, Watcheye allows you to create and apply different rules for various customers. This means you can tailor your monitoring efforts based on factors such as customer type, their risk, their location or business type.

Does WatchEye support AUSTRAC Tranche2 entities?

Yes. This is exactly what WatchEye is created to support. This system plays a vital process in your company’s Ongoing KYC and AML-CTF compliance program and backbook screening. Manage identity verification and ongoing monitoring in one, easy to access portal.

Does WatchEye support and screen international customers as well?

Yes, WatchEye is designed to support not only local compliance standards (such as AUSTRAC) but also global regulations, including FATF recommendations and GDPR. This makes it a versatile solution for businesses operating internationally, ensuring they meet diverse compliance and risk management obligations. Screen and monitor globally for PEPs and Sanctions and Adverse Media.

Can my onboarding files automatically integrate with WatchEye?

Yes, WatchEye is designed for seamless integration with your existing systems. Whether you prefer a SaaS model or API integration, WatchEye can be incorporated into your current workflows with minimal disruption, providing a unified compliance and security solution.

What types of alerts can WatchEye provide?

WatchEye offers a range of alerts, some of the most that is offered in one screening platform. Book a demo with our office to see what is available.

What alert frequency can WatchEye support?

You have control to set the desired monitoring and alert frequency. Simply prioritise your alerts according to the level of risk on your customer files or transactions. From daily to monthly or configure your own schedule.

How quickly can I start using WatchEye after signing up and can I trial it free?

Yes, you can trial or test WatchEye’s functionality for free. Once you sign up, setting up WatchEye is quick and straightforward. After loading your data files and configuring your monitoring preferences, you can start receiving alerts almost immediately. Our support team is available to assist you with the setup process to ensure a smooth transition.

What is the cost of WatchEye?

WatchEye pricing is costed based on the data monitors activated and consumed. It is transaction based. There are no costs or limits associated on how many customers you enrol, the costs vary depending on how many monitors are activated and scheduled to run. Please contact us for full pricing details.

Who we work with

To discover our specific client partnerships, request our product summaries. Details on who we collaborate with are included therein.

Leading Products For All Your Data Needs

Our Products

We are an Australian RegTech, providing solutions to fight financial crime and fraud, tailored to the dynamic needs of the AML-CTF industry. Explore our suite of products below, and learn how they enhance the quality and completeness of your workflows.

WatchEye

WatchEye brings everything together, including real-time KYC/KYB alerts, ongoing monitoring, plus identity, document, and biometric verification. It is an all-in-one customer onboarding system.

IDFEX ID Check

IDFEX provides fast, one-to-one Australian identity, document, and data verification checks, in an easy-to-use SaaS platform. Instantly verify government IDs online.

ID Pass

IDPass lets customers verify their identity and biometrics on their smartphone easily while keeping full control of their data. Generate and send your customers a link to verify themselves.

Australian Death Check

The Australian Death Check is Australia’s only official national death data source. Our platform provides accurate, compliant, and instant access to millions of death records.

Caspar KYC

CASPAR is Australia’s top data tool for finding, verifying, and identifying consumers. It uncovers hidden KYC data with rich background and contact details on your customers.

API

Our RESTful API connects smoothly with all software environments, providing tailored, pre-configured, and ready-to-use queries within our SaaS systems. Built to address data issues and drive automation.

Insiight Enrichment

Insiight improves customer data quality by verifying, correcting, and enriching records so they remain accurate and useful. Instantly append fresh information across your database.

Quester Marketing

Quester makes it easy to build targeted Australian marketing lists. Use smart filters to create privacy-compliant campaigns that match your audience. Only pay for the data that you download.

"*" indicates required fields

"*" indicates required fields