KYC Software For Identifying And Verifying Consumers

Go beyond the standard KYC checks and return unique data such as deceased status, real estate info, employment history, court listings, social media profiles and more.

Support Enhanced Customer Due Diligence (ECDD)

Access real-time verified identity data

Minimise risk with audit-ready reports

No training or complex inputs required

ISO 27001 certified company

Collecting, Verifying, and Completing Customer Data

Caspar’s streamlined KYC workflow captures the four data points AUSTRAC requires, validates each one against multiple trusted sources, and automatically fills any gaps in the record. The result is a complete, accurate customer profile with minimal friction for your team or the applicant.

Data points confirmed and supplemented

- Full legal name – matched across independent records to assure consistency.

- Date of birth – cross-checked with authoritative datasets to confirm accuracy.

- Residential address – validated against current address and databases for proof of residence.

- Contact details – phone numbers and email addresses verified in real time, with additional channels added when available to close information gaps.

How a Single Search Leads to Full KYC Verification

Harness Australia’s largest consumer dataset, covering over 2 billion current and historical records, to confirm identity, assess risk and generate audit-ready evidence in seconds.

Smart Search Input

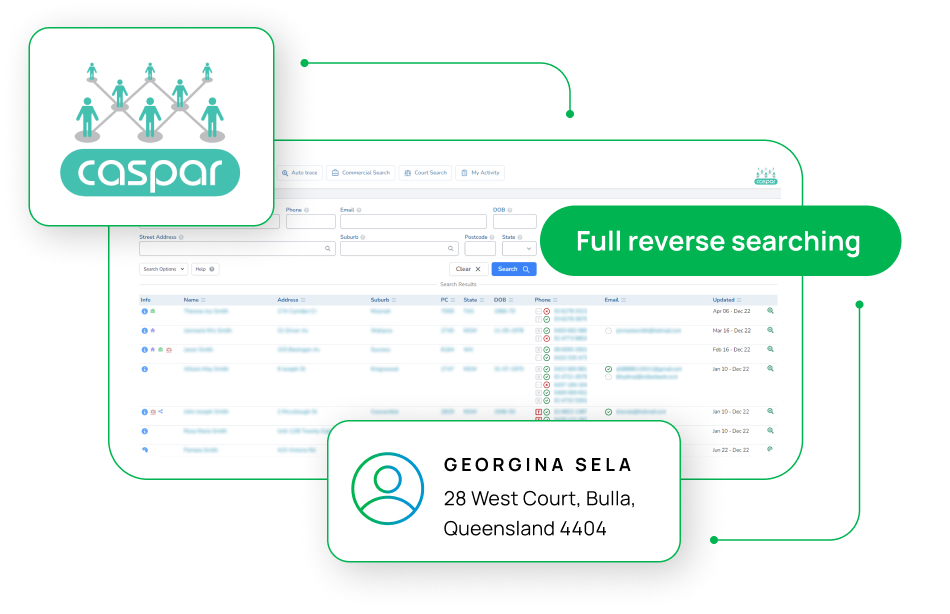

Enter a name, email, phone number or address. Caspar intelligently adjusts for variations and connects relevant records to widen the search and improve match accuracy.

Real-Time Data Matching

Caspar checks over 2,000 trusted data sources in real time. It verifies identities and returns valuable insights such as court data, property links, past addresses, contact details, and other information to support risk assessment and compliance.

Clear Verified Profile

Receive a verified customer profile with matched results and supporting insights. Every result is clear, actionable, and formatted for fast review, export, or use in your compliance processes.

Enhanced Customer Due Diligence for High-Risk Customers

When standard KYC checks aren’t enough, our Enhanced Customer Due Diligence (ECDD) workflow provides the depth regulators expect and risk teams need. Go beyond surface-level identity verification and build a well-rounded risk profile before you onboard or transact.

Key insights available through ECDD:

- Social Media Profiles: Uncover the digital presence across various platforms.

- Business Affiliations: Gain insights into professional associations and roles.

- Employment History: Compare supplied employment details with historical records to spot anomalies.

- Real Estate Details: Access information on property ownership and real estate interests.

- Legal Records: Review any available civil or criminal legal records for comprehensive background checks.

- Demographic Insights: Delve into detailed demographic information for a deeper understanding.

- Demographic Insights: Delve into detailed demographic information for a deeper understanding.

- More Ways to Connect: Find extra email addresses and phone numbers to broaden your outreach.

WANT THE FACTS BEFORE MAKING A DECISION? OUR OVERVIEW PROVIDES YOU WITH KEY FEATURES AND PRICING OPTIONS

Get Our Complete Product Overview and Pricing Guide Today

Why Finance and Compliance Teams Trust Caspar

Access the verified data you need to complete KYC checks confidently, meet compliance obligations, and reduce manual effort.

Verified from Reliable Sources

Access Australia’s largest consumer dataset, updated weekly for accuracy and compliance readiness.

Audit-Ready Documentation

Every check produces PDF documentation you can export and present for audit purposes.

Support for ECDD Requirements

Gain visibility into legal records, property links, employment history, and other high-value KYC data to support more rigorous compliance checks.

Flexible Search Options

Enter a name, phone number, email or address. No formatting rules or training required

Secure and Certified

Caspar is ISO 27001 certified and hosted in secure Australian data centres. Data is encrypted in transit and at rest, with access restricted, monitored, and regularly reviewed.

See How Basic Information Leads to In-depth Profiles

Still Relying on Manual or Basic ID Checks?

Manual processes and outdated tools create friction, delay onboarding, and increase compliance risk. Caspar removes uncertainty by providing real-time clarity and delivers clear KYC results on the first attempt.

Manual Identity Checks and Outdated Data

Legacy processes often rely on static databases, disconnected systems, and manual data entry. These methods increase the risk of mismatches, slow down onboarding, and make it harder to meet compliance obligations with confidence.

- ✕ Manual identity checks and static databases.

- ✕ Siloed systems with limited data coverage.

- ✕ No structured audit trail.

- ✕ Limited visibility into customer background.

- ✕ Delayed onboarding and false negatives

Real-Time KYC with Caspar

Caspar simplifies customer verification by instantly searching Australia’s largest compliance-ready dataset. From identity confirmation to deeper due diligence insights, Caspar delivers structured, audit-ready results that reduce manual effort and support confident decision-making.

- ✓ Real-time search with verified data sources.

- ✓ Weekly-updated national dataset from 2000+ sources.

- ✓ Audit-ready reports with search logs.

- ✓ Legal, employment and property links included.

- ✓ Clear, structured results designed for fast decision-making.

What our customers say about Caspar

Request a Demo"*" indicates required fields

"*" indicates required fields

Frequently Asked Questions

How does Caspar differ to competitor solutions?

Caspar provides unmatched system and data security, featuring multi-factor authentication and granting clients access to structured and transparent data lineage. Competitor solutions fall short of Caspar’s standards, that include real-time, compliant, and authoritative data sources, along with its trusted ISO-certified processes for data storage. Some competitors can’t demonstrate compliantly, where their data was sourced and place your organisation at risk of privacy complaints.

What questions should I consider when selecting a data vendor?

When evaluating data vendors or data systems, it is crucial to verify their commitment to exceptional data security standards, given the highly private and confidential nature of the data being entrusted to their systems. At a minimum, ensure they can present their ISO certifications, complete data and security attestations, and clearly articulate their data retention policies by providing evidence. Some competitor vendors lack the ability to furnish this essential and basic information, potentially exposing your organisation to significant data privacy risks and therefore cannot be approved in your ‘Supply Chain.’

How often is the data in Caspar updated?

Caspar’s data is updated in real-time, with the integration of hundreds of thousands of new records every Monday and monthly updates to data-card changes. This ensures the most current and comprehensive information is always available. In contrast, many competitor solutions update their systems only once or twice a year, significantly lagging behind Caspar’s dynamic and timely data refreshment.

Am I able to see how a record was constructed?

Yes, Caspar offers comprehensive data lineage, a feature that is enabled by default for our banking and fintech clients. Should this be a requirement for your organisation, we can readily activate it on your account. Caspar stands alone as the only solution in the market that provides full data lineage, ensuring adherence to privacy standards and ISO compliance, setting it apart from many competitor solutions.

What is the consumer suppression process?

We assure our clients of comprehensive consumer suppression support, complete with a dedicated contact department. When utilising Caspar, you are guaranteed assistance in clarifying to consumers how and where their records were obtained. Our proactive support in this process significantly reduces the likelihood of privacy complaints from disgruntled consumers. A notable number of our recent clients have transitioned from competitor services, which lacked effective suppression processes, that could lead to national Australian Privacy Principle (APP) concerns.

What makes the Caspar social media data different?

Caspar stands at the forefront of social media data accuracy, supplying information exclusively when it is linked to consumer universe data metrics. Uniquely, we offer the only system capable of conducting social media verifications through two distinct methods: first, via contact metrics, and second, through social media URLs. This dual-capability verification process is unmatched by any competitor, positioning Caspar as a leader in the field.

Is Caspar just a skiptracing platform?

Caspar is now extensively utilised in fraud detection and by the banking sector for Know Your Customer (KYC) processes. Originally developed as a skip tracing engine, Caspar has evolved to master this function with ease. Today, it is leveraged by law enforcement, forensic investigations, identity verification, and various other industries, demonstrating its versatility and effectiveness across a broad spectrum of applications.

Is ISO27001 important when choosing a data vendor?

Yes. When handling sensitive data, it is imperative to partner with a data vendor that is ISO compliant. This ensures that your company can demonstrate compliance throughout the supplier chain. Engaging with any competitor system that lacks ISO compliance should be avoided, to mitigate risks and uphold stringent data security and privacy standards.

What is the cost of Caspar?

We offer two levels of license subscriptions, Caspar Basic and Pro, that are cost-effective and suitable for businesses of all sizes. Contact us for our tiered plans.

Is there a limit to the number of searches I can perform in Caspar?

No, there is no limit to the number of searches you can perform in Caspar. You can conduct as many searches as you need.

How soon can I get access to Caspar?

Our team will set you up with access usually the same day or the next.

Is Caspar compliant with data privacy laws?

Caspar adheres to Australian data privacy laws, including the Privacy Act 1988 (Cth) and the National Australian Privacy Principles (APP) regulations. Our data collection practices are in strict accordance with our ISO 27001 controls, ensuring the highest standards of data security and privacy compliance.

Do we get support and training with Caspar?

Yes, we provide friendly staff and free training sessions to assist you.