End-to-End Identity Verification

The Platform Finance Teams Trust for KYC

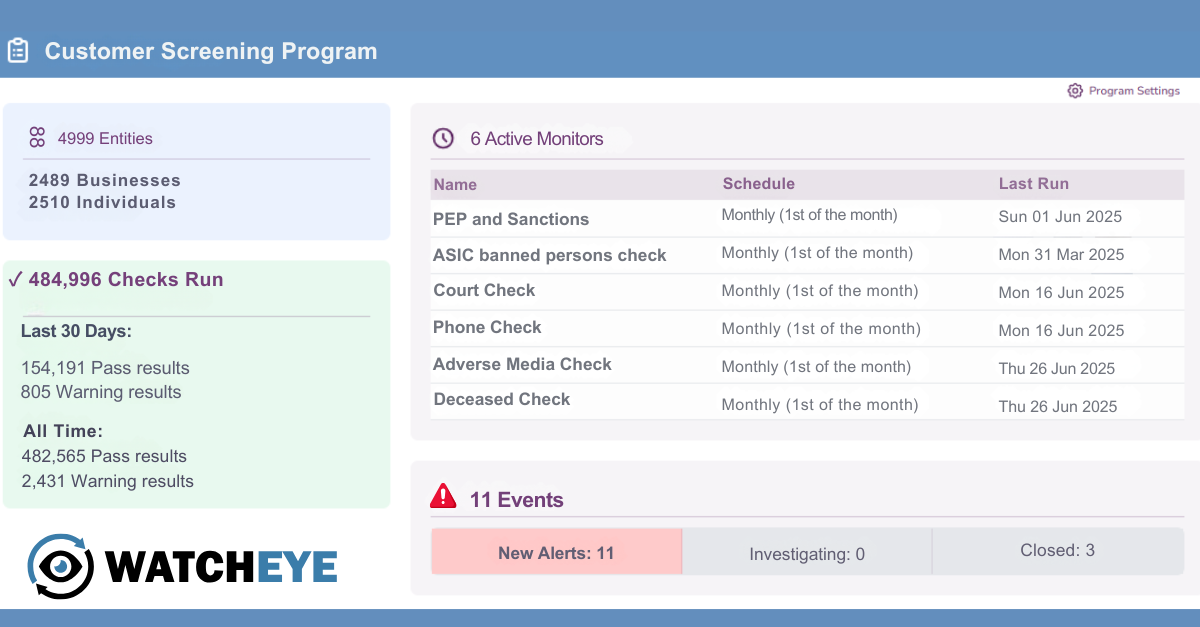

IDFEX gives Australian financial institutions clear, centralised control over identity verification. From one platform, teams can cross-reference customer data, validate IDs, and confirm liveness.

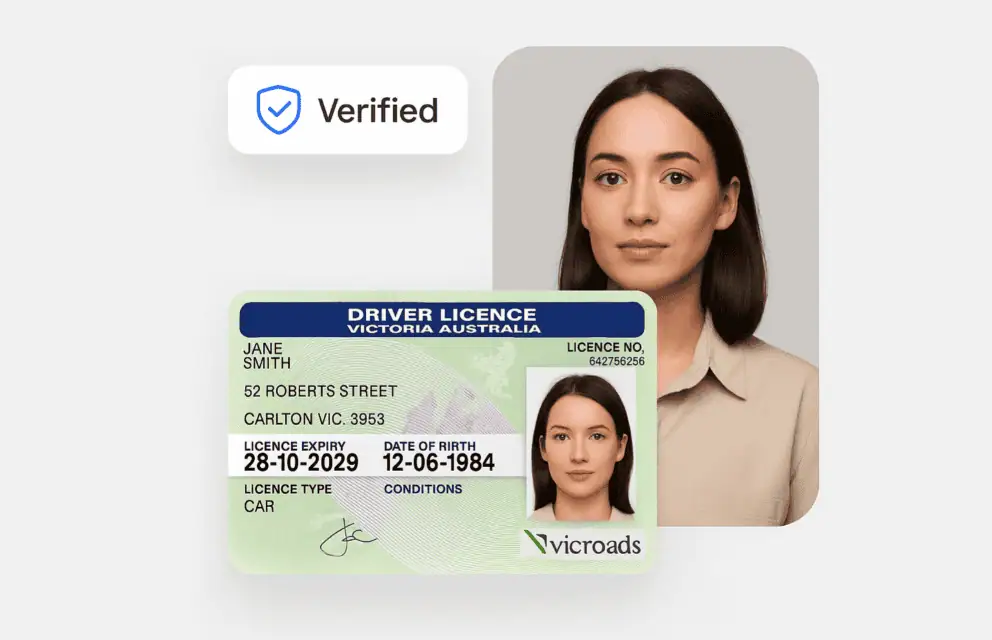

Check customer Name, Email, DOB, and Phone Number.

Confirm liveness with biometric and facial recognition checks.

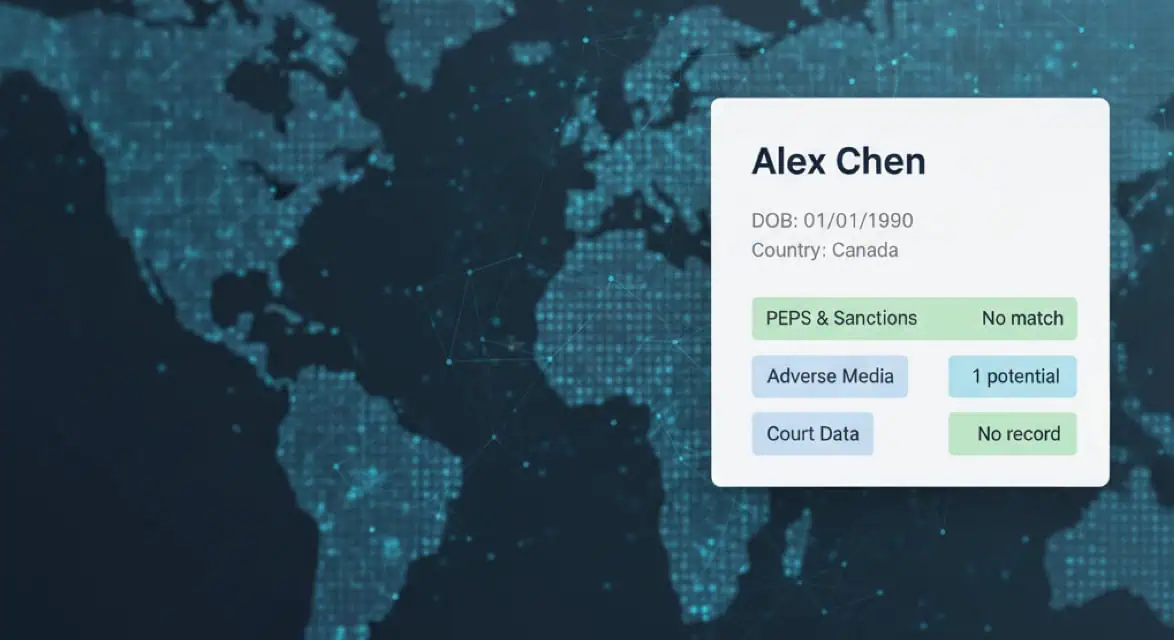

Screen against global AML/CTF, PEPs, and Sanctions watchlists.